Definition: RSI diversence is a technical tool for analysis that compares the price of an asset to the direction that it is in relative strength (RSI).

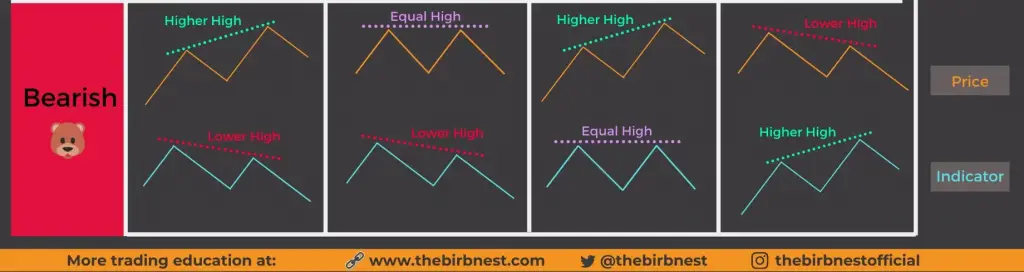

Signal A positive RSI signal is thought of as to be a bullish signal, while the negative RSI deviation is believed to be bearish.

Trend Reversal : RSI divergence may indicate the possibility of a trend reversal.

Confirmation - RSI divergence should be used in conjunction with other analysis methods.

Timeframe: RSI divergence is possible to be examined over various timespans in order to get diverse perspectives.

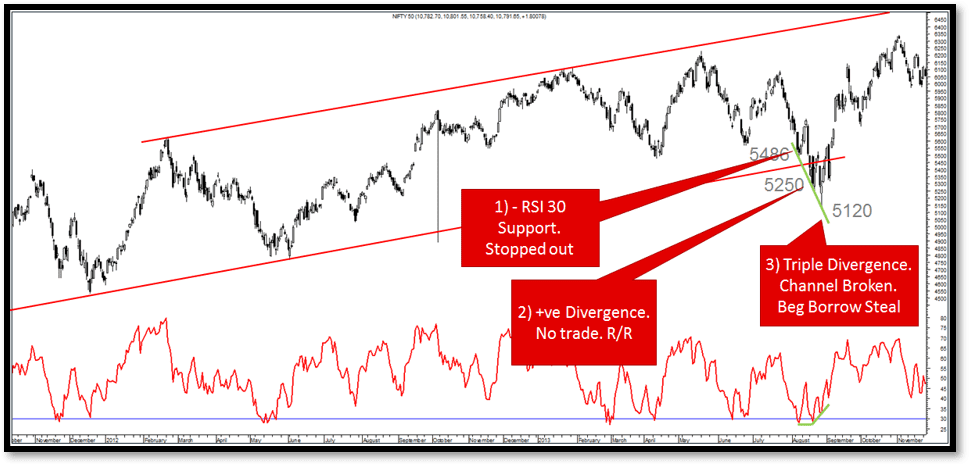

Overbought/Oversold RSI: RSI values higher than 70 indicate an overbought situation in contrast to values that are less than 30 indicate oversold.

Interpretation: Interpreting RSI divergence correctly requires considering additional fundamental and technical aspects. View the most popular backtesting strategies for more tips including backtesting trading strategies, automated trading, forex backtesting, automated trading platform, automated crypto trading, best crypto trading platform, crypto trading bot, forex backtest software, backtesting strategies, automated trading bot and more.

[img]https://i0.wp.com/www.dolphintrader.com/wp-content/uploads/2018/06/Forex-Trading-Strategies-With-RSI-Indicator.png?ssl\u003d1[/img]

What Is The Distinction Between Regular Divergence And Concealed Divergence

Regular Divergence: This occurs when an asset's price is at a higher level or lower than the RSI. It could signal a trend reversal. However, it is important to take into account other fundamental and technical factors. This is not as clear as normal divergence, however it could signify a trend reversal.

Think about these technical considerations:

Trend lines and support/resistance indices

Volume levels

Moving averages

Other oscillators and technical indicators as well as other oscillators

Think about these basic elements:

Data on economics released

Information specific to your company

Market sentiment and mood indicators

Global Market Events and Impact on the Market

Before taking investment decisions based upon RSI divergence signals, it is crucial to think about both the technical and fundamental aspects. Read the best crypto trading bot for blog recommendations including crypto trading backtester, forex backtesting software free, backtesting, stop loss, divergence trading, trading with divergence, software for automated trading, automated cryptocurrency trading, forex trading, automated trading and more.

What Are The Backtesting Strategies When Trading Crypto

Backtesting trading strategies in cryptocurrency trading involves simulated implementation of a strategy for trading on historical data to determine its potential profitability. The following are some steps in backtesting crypto trading strategies:Historical Data: Obtain a historical data set for the crypto asset being traded, including prices, volume, and other relevant market data.

Trading Strategy: Develop the trading strategy to be test.

Simulation: You can utilize software to simulate how the trading strategy will be executed using historical data. This allows you to observe how your strategy will perform in the future.

Metrics. Utilize metrics like Sharpe ratio or profitability to determine the effectiveness of the strategy.

Optimization: To improve the strategy's performance, tweak the parameters of the strategy, and then perform a second simulation.

Validation: Test the strategy's effectiveness using out-of-sample information to confirm its robustness.

It is important to be aware that past performance is not an indicator of future performance, and backtesting results should not be relied upon as an assurance of future earnings. It is also important to think about the effect of the volatility of markets along with transaction costs and other real-world considerations when applying the strategy for live trading. Have a look at the most popular cryptocurrency trading for blog recommendations including bot for crypto trading, trading platform crypto, automated cryptocurrency trading, backtesting tool, trading divergences, forex tester, crypto backtesting, crypto trading, backtesting, backtesting platform and more.

What Is The Best Way To Examine Forex Backtest Software When You Trade With Divergence

When looking at forex backtesting software to trade using RSI divergence, these factors should be considered:Data Accuracy: Ensure the software has access to high-qualityand precise historical data for the currency pairs that are traded.

Flexibility: The program should allow customization and testing of different RSI divergence strategies.

Metrics: The software should offer a variety of metrics to evaluate the performance of RSI diversification strategies such as profit, risk/reward ratios drawdown, and other relevant metrics.

Speed: Software must be fast and efficient in order to enable multiple strategies to be tested quickly.

User-Friendliness. Even for those who do not have a lot of expertise in technical analysis, the software must be user-friendly.

Cost: Look at the cost of the software. Also, consider whether the software fits within your financial allowance.

Support: The program should provide good customer support, with tutorials and technical assistance.

Integration: The software needs to be able to integrate with other tools for trading, such as charting software or trading platforms.

It is important to test the software using an account with a demo before you purchase an annual subscription. This will allow you to verify that the software meets your needs and are comfortable using it. Check out the recommended automated trading for site info including automated trading, forex backtesting, RSI divergence cheat sheet, best trading platform, trading divergences, forex backtest software, RSI divergence cheat sheet, cryptocurrency trading bot, automated trading software, position sizing calculator and more.

How Can Automated Trading Software Integrate With Cryptocurrency Trading Bots?

Following a set of predefined rules, cryptocurrency trading robots make trades on behalf of the user. Here's how they work.

Integration: Through APIs, trading bots may connect to exchanges for cryptocurrency. They are able to access real-time market data and execute orders.

Algorithm: The robot employs algorithms to analyse market data and make choices in accordance with the trading strategy.

Execution: The robot performs trades on its own based on the trading strategy without any manual intervention.

Monitoring: The robot monitors the market continuously and adjusts the strategy accordingly. See the best position sizing calculator for website examples including automated trading, bot for crypto trading, divergence trading, crypto trading bot, automated cryptocurrency trading, divergence trading, automated trading platform, forex backtester, trading platform cryptocurrency, position sizing calculator and more.

The usage of robots to trade cryptocurrency is useful in executing complex or routine trading strategies. This eliminates the need to intervene manually and allows traders to benefit from market opportunities throughout the day. It is important to recognize that automated trading has its own risks. Software bugs, security issues, and the loss of control over the trading process are just one of the potential dangers. It is vital to evaluate and test the trading robot before it is able to be employed for live trading.