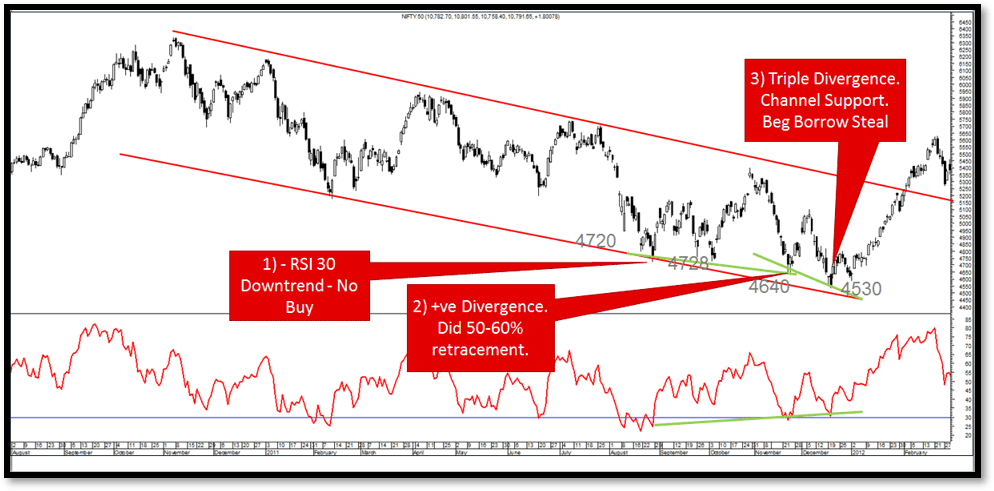

Divergence is in the event that an asset's price and the direction of an indicator move in opposite directions. Divergence between momentum indicators such as the RSI or MACD is a useful tool to identify possible changes in an asset's direction. It is a key component of many trading strategies. We are proud to announce the availability of divergence that allows you to create closed and open conditions in your trading strategies via cleo.finance. Check out the best crypto trading backtesting for more recommendations including jump trading crypto, spread in forex, buy forex, crypto to crypto exchange, currency pairs list, binance buy sell fees, forex trading hours, mt4 indicators list, cryptocurrency trading sites, fbs copy trade minimum deposit, and more.

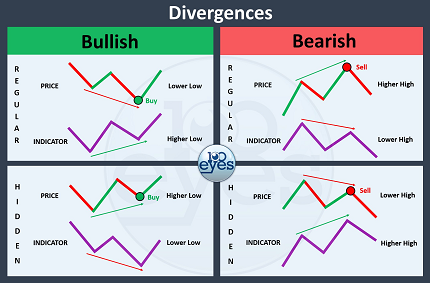

There Are Four Kinds Of Divergences.

Bullish Divergence

Price is showing lower lows as the technical indicator displays higher lows. This indicates a weakening trend of a downtrend. This could lead to a reversal on the upward trend.

Hidden Bullish Divergence

Price is making higher lows , while the oscillator has lower lows. A bullish divergence that is hidden can signalize that uptrend will peRSIst and is usually found near the bottom of a price throwback (retracement down).

Hidden Bullish Divergence explanation

Quick Notes

Bearish Divergence

As price sets higher highs, the technical indicator displays lower highs. This indicates that the momentum on the upside is waning and there is an upward trend reversal to the negative.

Bearish Divergence Explanation

Quick Notes When the indicator is in an upward trend and the peak is clearly visible then it will be moving down first.

Hidden Bearish Divergence

The oscillator is making higher highs and it is making lower lows. A bearish divergence that is hidden could signal that the downtrend is still going on. This can be found near the end of a price pullback, or a retracement up.

Hidden Bearish Divergence Explanation

Quick Notes: Price goes down when price peaks in a downtrend drawback

Regular divergences provide a reversal signal

The presence of frequent divergences can indicate that a trend is about to reverse. They may signal that a trend is robust, but momentum has diminished and are an early sign of a possible direction change. Divergences can be powerful triggers for entry. See the recommended automated trading for website advice including ipda forex, free tradingview bot, forex chart, mt4 market, most traded currency pairs, best crypto site for day trading, best leverage to use in forex, rsi and price divergence, forex syariah, forex market hours, and more.

Hidden Divergences Signal Trend Continuation

Divergences hidden from the other side are signals of continuation that typically are found in the middle of the trend. These signals can indicate that the current trend might peRSIst after a pullback. Trading professionals often employ hidden divergences to join an established trend following an upward pullback.

Validity Of The Divergence

The usual use for divergence is to use a momentum indicator - such as RSI or Awesome oscillator or MACD. These indicators don't focus on past momentum. Thus the ability to predict divergence greater than 100 candle distance from now is not possible. The indicator's look-back time can be altered to determine if there is an actual divergence. In determining the validity or non-validity of a divergence, you must use discretion. There are many divergences that are not valid!

Available Divergences in cleo.finance:

Bullish Divergence

Bearish Divergence

Hidden Bullish Divergence:- Follow the recommended position sizing calculator for blog recommendations including adam khoo forex, icmarkets webtrader, top apps to buy cryptocurrency, mt4 auto trading software, forex account management services, reputable crypto exchanges, thinkscript automated trading, automated emini trading systems, best forex trading courses, best forex auto trader, and you can compare those divergences between two points:

Price With An Oscillator Indicator

An oscillator indicator as well as another indicator. Price of any asset with any other asset.

How do you make use of divergences using cleo.financebuilder

Hidden Bullish Divergence cleo.finance - Building open conditions

Customizable Parameters

Four parameters can be modified for all divergences so traders can modify their strategies to diverge.

Lookback Range (Period)

This parameter determines the distance back to which strategy should search for the divergence. The default value is 60. This means "Look for the divergence at any time within the last 60 bars."

Min. Distance Between Peaks/Troughs (Pivot Lookback Left)

This parameter specifies how many candles on the left side are required to verify that the pivot point is discovered.

Confirmation bars (Pivot Lookback Right)

This parameter indicates the number of bars that need to be added to the right side to confirm that the pivot has been located. Take a look at best cryptocurrency trading bot for more tips including forex watch, world largest crypto exchange, international crypto exchange, price action automated trading, newton crypto exchange, binance futures us, binance trading platform, xm metatrader 4, cryptocurrency platforms usa, rsi hidden bullish divergence, and more.

Timeframe

This section allows you to specify the timeframe in which the divergence must take place. This timeframe can be different from the execution timeframe of the strategy.Customizable parameter settings of divergences on cleo.finance

The Divergences parameter settings for cleo.finance

The pivot point settings define the point at which each divergence reaches its peak. Keep the default settings of a bullish Divergence

Lookback Band (bars): 60

Min. Distance between the troughs (left), = 1

Confirmation bars Right = 3

This setting requires that both troughs of the divergence have to be within the closest five bars. (Lower than one bar on each side and 3 bars on the sides). This must be true for both troughs that can be seen in the past 60 candle candles (lookback period). The divergence is confirmed 3 bars after the closest pivot point was found.

Available Divergencies In Cleo.Finance

The majority of the time, RSI or MACD divergence is used. However, you can try any oscillator you like and then trade it live on the trading automation platform cleo.finance. Take a look at top forex trading for site recommendations including esignal automated trading software, rsi divergence indicator mt5, stock market auto trading, tradingforex, reputable crypto exchanges, crypto trading ai, top forex signal providers, best crypto to trade, alpari mt4, the best ea forex 2020, and more.

In Summary

Divergences are an essential tool for traders to include in their arsenal, however they should be used in a careful and strategic way. Keep these tips in mind and traders will be able to utilize divergences to their advantage to make better trade decisions. It is vital to consider diveRSIfication with a clear and focused mind. The lines are utilized alongside technical and fundamental analysis like Fib Retracements, Support and Resistance lines and Smart Money Concepts to increase the validity of divergences. We have Risk Management guides for position sizing, stop loss placement. Start designing your ideal trading strategies for divergence right now with over 55 technical indicators, price action, and candlesticks data points! We continue to improve the cleo.finance website. Contact us if you have any questions or suggestions to improve the data points.