Automated Crypto Trading - Advantages

Increased Efficiency- Automated crypto trading systems can execute trades much faster than a human trader, reducing the impact of market events and emotions on trading decisions.Consistency- Automated crypto trading systems follow a set of pre-defined rules and conditions, which can lead to more consistent and predictable results compared to manual trading.

Increased accuracyThe automated trading systems that are used for crypto currencies use algorithms and historical information to make informed choices. They also reduce the possibility of human error.

Greater Scalability - Automated Trading Systems can manage multiple trades simultaneously, increasing the potential for profit.

24/7 Trading- The automatic crypto trading system works 24/7. This lets traders make the most of opportunities in the market even when they're not actively monitoring the market.

Automated Crypto Trading: The Advantages And Disadvantages

Dependence on technology- Automated crypto trading systems rely on software and technology, which may fail or be susceptible to hacking, resulting in massive losses.Lack of Flexibility - Automated crypto trading systems follow certain guidelines and rules that may not coincide with the current market conditions or the trader's goals.

Over-Optimization- Certain automated crypto trading platforms may be too sensitive to historical market data. This can result in an adverse effect on live trading performance.

Inadequacy of understanding - Crypto trading platforms that automate trading can be complex and difficult to comprehend. This makes traders unable to analyze their performance and adapt their strategies for trading.

Limits on Risk Management capability of risk management in the automated trading platforms for crypto may be limited, and this can result in substantial losses should market conditions suddenly change.

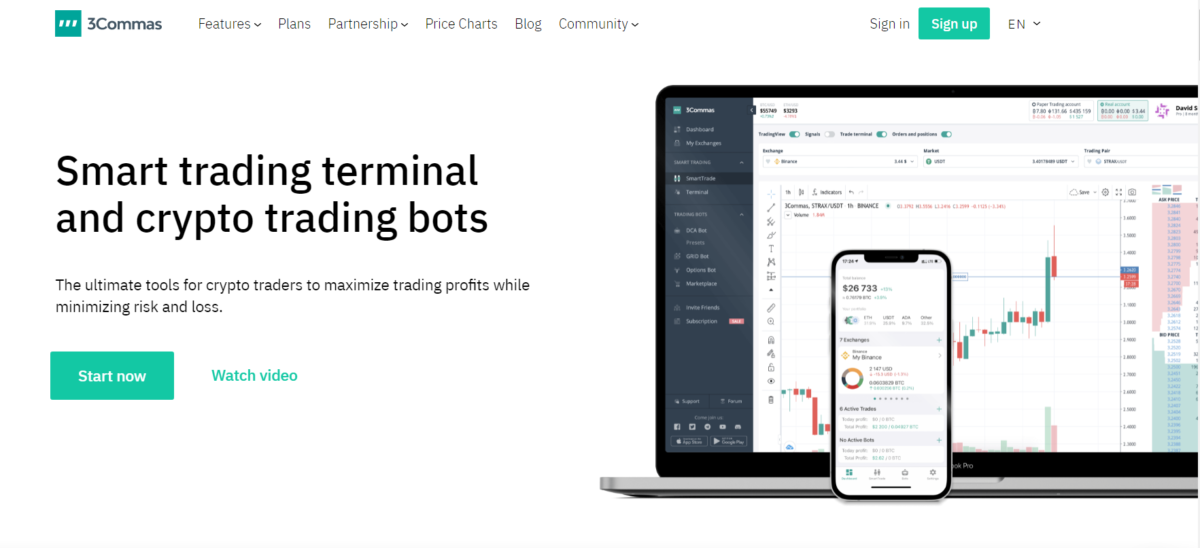

The advantages of automated crypto trading include increased efficiency, accuracy, and consistency. Automated crypto trading has its limitations, such as the dependence on technology and the inflexibility. Also, it requires some risk management. Before using automated crypto trading systems, traders should take a careful look at the advantages and risks. Have a look at the top crypto futures for site examples including backtesting in forex, best cryptocurrency trading bot, auto crypto trading bot, automated system trading, algorithmic trading crypto, automated trading system, forex backtesting software, algo trading strategies, backtesting tool, forex backtest software and more.

Is Crypto Automation Legal?

Insofar as the automated trading system is utilized in compliance with applicable laws the use of crypto-based automation is legal. It is important to be aware that the regulations and laws governing cryptocurrency, and automated trading can vary between different countries. This is the reason it is crucial to be familiar with the laws within your region.

Certain countries might impose limitations on cryptocurrency usage for investment or trading purposes. Some countries might have more permissive regulations. Additionally, some countries may have particular requirements regarding the use of automated trading systems. These include reporting and licensing obligations.

The legality of crypto automation is contingent on the laws and regulations applicable to the region in which it is used. It is essential to be familiar with the regulations in your area and to comply with all applicable laws and regulations when using crypto automation. Follow the most popular best trading platform for site info including algo trade, position sizing calculator, best crypto trading bot, backtesting trading strategies, best automated crypto trading bot, best crypto trading bot 2023, psychology of trading, what is algorithmic trading, cryptocurrency trading bot, forex tester and more.

Is Automated Trading In Crypto Safe?

Automated cryptocurrency trading is safe If there are many aspects that affect its security including the quality of the software, its reliability as well as data accuracy and methods for managing risk. Automated crypto trading comes with many advantages. It's more efficient and less prone to human errors. However, it is important that you are aware of the dangers and risks. For example, automated crypto trading systems could depend on software and technology which fail or be vulnerable to hacking, leading to substantial losses. In addition automated trading systems could lack the ability to manage risk. This could result in large losses when market conditions shift unexpectedly. It is vital to study the software providers and ensure that the automated crypto trading is safe. You should also be able to understand the algorithms and strategies of the system, and ensure that you keep your strategy for managing risk in order. Automated crypto trading is safe however you must be aware of the risks and take necessary steps to minimize them. Before using automated crypto trading platforms be sure to think about all potential advantages and seek advice from a professional should you require it. Have a look at the recommended backtesting software forex for more examples including automated trading, trading with divergence, crypto daily trading strategy, trading psychology, automated trading, stop loss meaning, backtesting trading strategies, backtesting software free, trading platforms, algorithmic trading crypto and more.

What Is An Example Of Backtesting A Simple Trading Strategy?

Let's say that you are able to purchase stock when its 50-day MA crosses above its 200-day moving average. Then, it will sell the stock if the 50-day MA is below its 200-day MA. To test the strategy, you'll need to collect historical daily price data for each stock you want to trade. The strategy is applied to data from the past, and the strategy's performance was tracked over time. For instance, let's consider five years as a data source. The method is then applied to the data. Results from backtesting indicate that the strategy could have brought in a total of $5,000 in profits over the five year period. Furthermore, the maximum drawdown of the strategy was $2,000; this signifies that the strategy has lost $2,000 at its lowest point. Additionally, the results show that the ratio of win/loss was 60/40, which means that the strategy has an average win rate of 60% and 40% loss rate. This is only an example. Backtesting can be more complicated and requires more rigorous techniques and tools to effectively evaluate the performance of a trading strategy. This illustration shows how to backtest and the types information you can discover in the simulation.