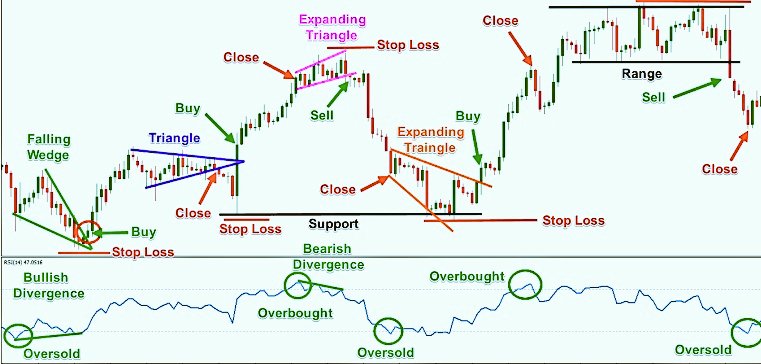

Definition: RSI Divergence is a technical analysis tool that analyzes the direction of an asset's price movement with the direction of its relative strength index (RSI).Types: There are two types of RSI divergence: regular divergence, and concealed divergence.

Signal: Positive RSI divergence signals an upward signal. Negative RSI divergence is an alarm for bears.

Trend Reversal - RSI divergence could indicate an upcoming trend reverse.

Confirmation - RSI divergence should always be used in conjunction with other analysis techniques.

Timeframe: RSI divergence can be observed on different timeframes in order to gain different insight.

Overbought/Oversold RSI values above 70 indicate overbought conditions. Values lower than 30 indicate undersold conditions.

Interpretation: To interpret RSI divergence in a correct manner, you need to be aware of other fundamental and technical factors. Take a look at top automated trading bot for more advice including backtesting platform, best trading platform, trading platform, crypto trading bot, best crypto trading platform, automated trading software, RSI divergence cheat sheet, divergence trading, best forex trading platform, forex backtesting software free and more.

What Is The Difference Between Regular Divergence And Hidden Divergence

Regular Divergence: A regular divergence is when the price of an asset is higher highs or lower low, and the RSI is able to make a lower low or higher low. It could be an indication of a trend reversal but it is important that you take into consideration other technical and fundamental factors. Hidden Divergence: when an asset's price is lower highs or lower lows, when the RSI is able to make a higher or lower low. This could indicate that a trend reversal could be possible, even though it is weaker than regular divergence.

Considerations regarding technical aspects:

Trend lines and support/resistance level

Volume levels

Moving averages

Other indicators and oscillators

Fundamental factors to consider:

Economic data released

Specific information specific to your business

Market sentiment and other sentiment indicators

Global events and the impact of markets

It is crucial to consider both fundamental and technical factors before investing in RSI divergence signals. Follow the top forex tester for more advice including trading platforms, forex trading, stop loss, crypto trading backtesting, position sizing calculator, divergence trading forex, backtesting trading strategies, best crypto trading platform, position sizing calculator, crypto trading and more.

What Are Backtesting Strategies For Trading Cryptocurrency?

Backtesting crypto trading strategies is replicating the operation of a trading strategy utilizing historical data in order to assess its effectiveness. The following are some steps in backtesting crypto trading strategies:Historical Data: Obtain a historical data set for the crypto asset being traded, including prices, volume, and other relevant market data.

Trading Strategy: Create the trading strategy to be test.

Simulation Software: Make use of software to simulate the operation of the trading strategy based on the historical data. This allows you see how the strategy might have performed over time.

Metrics: Determine the effectiveness of the strategy by using metrics such as profitability and Sharpe ratio, drawdown and other relevant measures.

Optimization: Adjust the strategy parameters, and then run the simulation again to optimize the strategy's performance.

Validation: Test the strategy's effectiveness using out-of-sample data to verify the strategy's robustness.

Remember that past performance does not necessarily guarantee future results. Results from backtesting can't be relied upon as a guarantee of future profits. When applying the method for live trading it is crucial to consider market volatility, transaction cost, and other real-world considerations. View the most popular best trading platform for site examples including forex backtesting software free, divergence trading forex, forex backtesting, forex backtester, backtester, backtesting, trading platform crypto, automated forex trading, trading platforms, divergence trading and more.

What Can You Do To Review The Forex Backtesting Software When Trading Using Divergence

These are the main aspects to consider when looking at forex backtesting software that allows trading using RSI Divergence.

Flexibility: Different RSI divergence trading strategies are able to be modified and tested using the software.

Metrics: This software should offer a wide range of metrics that are used to assess the performance and the profitability of RSI divergence strategies.

Speed: Software should be efficient and fast that allows you to test quickly multiple strategies.

User-Friendliness: Software should be intuitive and easy to understand for anyone without any technical background.

Cost: Take into account the cost of the software, and determine whether you can afford the cost.

Support: The program should provide good customer support, including tutorials and technical support.

Integration: The software needs to integrate well with other trading software , such as charting software and trading platforms.

To ensure the software is a good fit for your needs and you are comfortable with it, you should try it out first with an account that is demo. Take a look at best backtesting strategies for more examples including backtesting trading strategies, RSI divergence, crypto trading backtesting, software for automated trading, crypto trading bot, forex backtesting software, trading platform cryptocurrency, automated trading software, trading platforms, automated trading software and more.

How Do Cryptocurrency Bots For Trading Function Within Automated Trading Software?

The bots for trading cryptocurrency work within automated trading software that follows an established set of guidelines and making trades for the user's behalf. This is how they work: Trading Strategies: The trader decides a trading strategy, including entry and exit rules, position sizing, and the rules for managing risk.

Integration Through APIs, the trading bot can be connected to cryptocurrency exchanges. This allows it to access real time market data and then execute trades.

Algorithms are algorithms that study market data in order to make trading decisions based in part on a specific strategy.

Execution: The bot automatically executes trades based on the rules outlined in the trading strategy, without the need for manual intervention.

Monitoring: The robot constantly examines the market and makes adjustments to the trading strategy when needed. Take a look at recommended backtesting trading strategies for site examples including online trading platform, trading platform cryptocurrency, bot for crypto trading, backtesting, forex backtest software, crypto trading, forex backtester, stop loss, forex tester, best forex trading platform and more.

The cryptocurrency trading bots can be utilized to execute complex or repetitive trading strategies. This means that there is less intervention by hand and lets users to profit from market opportunities 24/7. Automated trading comes with risks. There are security risks and software errors. There is also the possibility of losing control over the trading decisions you make. Before you use any bot to trade live trading, it is essential to thoroughly evaluate and test the bot.